My GPF

Description of My GPF

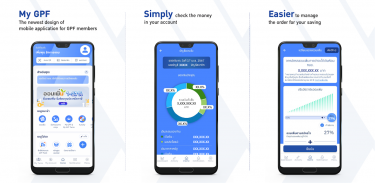

My GPF is a mobile platform designed to provide end-to-end services for members of Government Pension Fund (GPF). This application allows users to conveniently manage their retirement plans and access a variety of member services. Available for the Android platform, users can download My GPF to take advantage of its comprehensive suite of features aimed at enhancing the experience of GPF members.

The app provides users with the ability to view their savings account activity. Members can easily track their contributions and understand their savings growth over time. This feature is essential for those who wish to keep an eye on their financial progress and make informed decisions about their retirement funds.

Investment management is another core function of My GPF. Users can select or change their investment plans directly through the app, facilitating a personalized approach to retirement savings. This flexibility allows members to align their investments with their financial goals and risk tolerance, ensuring better future security.

My GPF offers a digital membership card, which members can access directly from the app. This card not only represents membership but also enables users to receive special privileges and discounts at various stores and services. The convenience of having this card on a mobile device eliminates the need for physical cards, making it easier for users to take advantage of their membership benefits.

In addition to membership management, the app includes a savings promotion information service. Through this feature, users can stay updated on opportunities to enhance their savings, ensuring they are making the most of their retirement plans. This proactive approach to financial literacy supports members in their long-term financial planning.

My GPF also provides a program designed to help members assess the sufficiency of their income after retirement. This feature encourages users to evaluate their financial readiness and make necessary adjustments to their savings strategies. By guiding members through this assessment, the app fosters a sense of security regarding future income.

For those seeking personalized advice, My GPF includes a financial advisory appointment service. This functionality allows members to schedule appointments with financial advisors, providing an opportunity for tailored guidance based on individual circumstances. This resource can be particularly valuable for users who may have specific questions or concerns about their retirement planning.

The app also integrates a Q&A service powered by a chatbot. This feature enables users to ask questions and receive instant responses, enhancing the overall user experience. Whether users have inquiries about their accounts or need assistance navigating the app, the chatbot serves as a helpful resource.

To further support its members, My GPF encourages users to report any issues or recommend services through the GPF Contact Center, which can be reached at 1179 or via Line at @GPFcommunity. This channel ensures that users have a direct line for assistance, reinforcing the app's commitment to member satisfaction.

The user interface of My GPF is designed to be intuitive, allowing members to navigate through various features with ease. The visual layout is straightforward, helping users to quickly find the information they need without unnecessary complexity. This focus on usability ensures that all members, regardless of their technical savvy, can effectively utilize the app.

Security is also a priority within My GPF. The app employs measures to protect users' personal and financial information, instilling confidence in members as they engage with their retirement accounts. This aspect is crucial for fostering trust in the app, particularly given the sensitive nature of financial data.

As more individuals look for ways to manage their retirement planning digitally, My GPF stands out as a useful tool for GPF members. The array of features available through the app supports members in various aspects of their financial journey. From monitoring savings to receiving financial advice, the application encompasses a wide range of services aimed at enhancing the retirement experience.

My GPF is equipped to meet the evolving needs of its users. By providing access to essential services and resources, it empowers members to take control of their financial futures. The combination of convenience, support, and security makes it a relevant choice for those preparing for retirement.

With its focus on member service and financial literacy, My GPF represents a significant advancement in how individuals engage with their retirement plans. By downloading the app, members can easily access a network of tools designed to facilitate effective retirement planning and management.

In summary, My GPF offers a comprehensive platform that combines essential features for managing retirement savings, promoting financial awareness, and providing support through personalized services. Members can confidently navigate their financial futures with the resources provided by this application.